IRS and the 990

As I mentioned in the post below the Urban Institute’s 990 online is getting ready to start processing the updated form 990. They hope to be ready to go by the end of July (not the end of June as I previously mentioned in my last post). There is a great piece in Blue Avocado about the system and a call to action to help improve it. Worth a read, especially for those thinking of jumping in and using the system.

As I mentioned in the post below the Urban Institute’s 990 online is getting ready to start processing the updated form 990. They hope to be ready to go by the end of July (not the end of June as I previously mentioned in my last post). There is a great piece in Blue Avocado about the system and a call to action to help improve it. Worth a read, especially for those thinking of jumping in and using the system.

Perhaps not everyone wants to read the IRS’s five year strategic plan? No problem, the nice folks at Guidestar have and let us know what the Internal Revenue Service has in store for tax exempt organizations. Between what they lay out here and several recent speeches by Lois Lerner and Sarah Hall Ingram (also reported on by Guidestar in the above link) we can be pretty sure of where their focus will lie. As the article points out, nonprofit should:

Pay the proper employment taxes on your staff; use appropriate comparable wage data to set executive compensation and document your decisions; file Form 990 promptly and accurately (and electronically, if possible); use efficient fundraising methods; and spend most of your revenues on achieving your tax-exempt purpose.

Good advice all around.

Managing in Tough Times

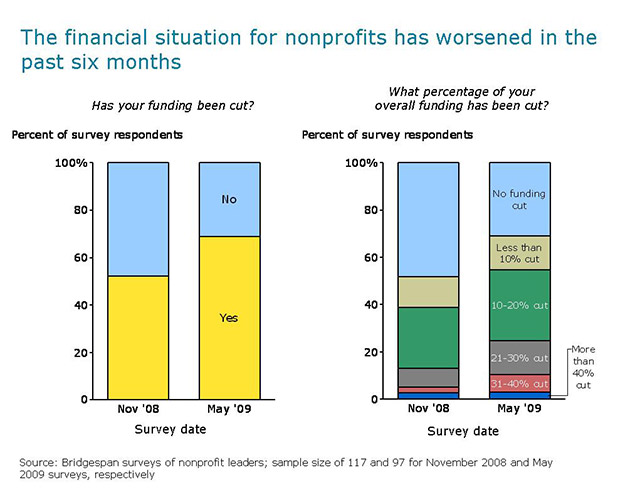

In case there was any confusion about it, times are still tight. Two items from the Bridgespan Group and The Listening Post Project give us an update, and California’s budget meltdown is being replayed in other states.

Bridgespan’s piece is a follow-up to their November 2008 7 Steps article. From the opening paragraph:

The percentage of nonprofits that have resorted to layoffs has increased, as has the percentage that has made broad-based programmatic reductions. More organizations have drawn down their reserves. Nonprofit leaders appear to be optimistic about the future, though: Almost half of the respondents reported that they believe their organization will be on stronger financial footing in a year’s time.

The Listening Post Project, from the Center for Civil Society Studies at Johns Hopkins University, released a new study, “Impact of the 2007-09 Economic Recession on Nonprofit Organizations” (link opens a PDF). From the executive summary:

Key findings from the 363 organizations responding to this Sounding include the following:

- 83 percent of responding organizations reported some level of fiscal stress during the target period of September 2008 to March 2009.

- Close to 40 percent of the organizations considered the stress to be “severe” or “very severe”.

- Theaters and orchestras were particularly hard hit, with 73 percent of the former and half of the latter reporting “severe” or “very severe” stress.

The deadline to pass California’s budget came and went last week. The Chronicle of Philanthropy has a good piece on how CA nonprofits will be effected by the state government’s game of chicken.

Nonprofit Financial Tools

I’ll try to end this post on a happier note with a couple of tips and resources! For accounting! Leading off is a recent article from Guidestar, “Ensuring a Smooth Annual Audit.” While it may not have a lot of revelations in it it is solid advice for any organization that is planning on a annual financial audit.

Tye Bridgespan Group is offering nonprofit organizations its new Nonprofit Cost Analysis Toolkit. This is a fine set of tools to help nonprofits understand what are the true, real, honest costs of running our organizations. Not knowing what it really costs your organization to do all that it does makes it difficult to move forward.

More cost analysis and fiancial tools can be found in my Managing Challenging Times section.