This weeks update features a great piece on using Social Capital, more human resource topics that didn’t make it in to the last post and the latest from the Internal Revenue Service that might affect your organization.

This weeks update features a great piece on using Social Capital, more human resource topics that didn’t make it in to the last post and the latest from the Internal Revenue Service that might affect your organization.

The Power of Social Capital

The Fieldstone Alliance has a great e-newsletter and this topic caught me eye: Mapping Your Networks to Mine Valuable Resources. From the article:

After Exploring all possible options for reducing expenses and increasing revenues, many nonprofits are stymied—how can they survive this downturn? Every nonprofit has another valuable resource that they can tap—social capital. Positive, productive relationships represent social capital, which is just as important (well, almost as important) as money in the bank.

Social capital has been described as the resources available to people based on the networks their relationships give them access to. Just as a skilled plumber knows how the water is piped throughout the house, a skilled nonprofit or community leader knows how social capital flows through their networks or community.

Check out the article for more.

More on Nonprofits Human Resource Issues

Are you, or have you ever had to draft a severance agreement? This article talks about a new publication from the Equal Employment Opportunity Commission that may be of help, even though some are renaming the document, “How to Sue Your Employer.”

Exempt employees can present a challenge to employers, nonprofit or for-profit, especially when it comes to the issue of docking an employee’s pay. Make a mistake and you can violate their exempt status and open your self up to a world of financial and legal hurt. This article and this article offer some guidance that may be of help. You should also make sure there are not any separate, or even more stringent state rules that may apply to your organization as well.

IRS Updates and News

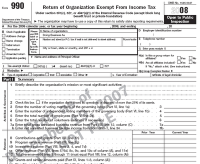

For those who have been waiting, efile.form990.org is ready to help you through filling out your 2008 form 990. They can also help you with several state filings as well, please do pay them a visit.

The final regulations for the 990-N, the electronic post card filing for small nonprofits have been released. No changes from the draft version, but it should be noted that organizations that are required to file the form and fail to do so for three consecutive years will automatically lose their tax-exempt status. Revocations will begin in May 2010.

The latest Form 990 filing tip is all about related organizations and schedule R. What is a related organization you ask? From the IRS:

Related organizations are organizations that stand in a parent/subsidiary relationship, brother/sister relationship, or supporting/supported organization relationship. Supporting and supported organizations are defined in section 509(a)(3) and 509(f)(3). Determination of the first two relationships depends on a definition of control set forth in the Form 990 instructions glossary and Schedule R instructions. The definition of control depends on whether the organization has owners or persons with beneficial interests.

Finally, the IRS wants us to make sure we handle donated property and non-cash contribution transactions the right way. Here is a page with several more links that might be of interest to any organization that receives non-cash contributions.