In the third and final installment of my news and information updates that clean out my in-boxes (the last two are here and here), I will lead off with two time sensitive items.

In the third and final installment of my news and information updates that clean out my in-boxes (the last two are here and here), I will lead off with two time sensitive items.

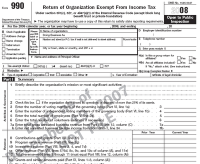

1. 990, 990-EZ, 990-PF and 990-N

Is your organization on a calendar fiscal year? Then your forms are do this Friday, May 15, 2009. From the IRS:

Calendar year exempt organizations that file Forms 990, 990-PF, or 990-EZ are reminded that their annual information returns are due on May 15. An organization may request an initial automatic extension of time to file its annual information return by filing Form 8868 by the due date of the return. For more information, see Form 8868 and its instructions [a pdf].

Forms 990, 990-EZ and 990-PF for non-calendar year organizations are due on the 15th day of the 5th month following the end of their annual accounting period.

Form 990-N filers cannot get an extension to file. Information about the 990-N can be found here.

Guidestar has a nice piece on what the governance aspects of the new forms are, you can read it here.