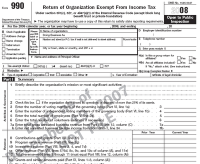

IRS, Governance and the Form 990

IRS, Governance and the Form 990

I’ll lead off with some exiting news. Well, it’s exiting to me at least. Last week I learned that the Urban Institute’s efile.form.990 site should start being able to process the latest version of the form 990 by the end of July (not June). Their system allows you to electronically prepare and file your organization form 990, 990 EZ and extensions to file. There is a small fee, but I encourage anyone who prepares your organizations forms by hand to look into their system.

Sarah Hall Ingram, the IRS Commissioner for Tax Exempt and Government Entities, made a presentation at Georgetown Law Center this week on nonprofit governance issues and what the IRS sees as its role relating to that.

While both state regulation and sector self-regulation are important, and I welcome and respect them, they do not get the IRS off the hook. Congress gave us a job to do, and we cannot delegate to others our obligation to enforce the conditions of federal tax exemption.

If you would like to read her remarks they are available as a PDF here.

Collaboration Resources

Need some tips on online collaboration tools? Gayle C. Thorsen at IMPACTMAX has a good rundown on some resources that should help you.

Questions and Answers: Revenue Recognition

Each year we have several matching gifts that come in after the fiscal year end of June 30. Should these receipts be counted toward the past fiscal year or the current year? For donor recognition purposes we count these gifts in the year they were pledged. For accounting purposes, how should we be dealing with this?

You should count them the same way you do for recognition. Nonprofit accounting rules for donations take into account the donors intent, and if the check was written in before the end of your fiscal year, or the pledge was made before then end of your fiscal year, it should be counted as that fiscal years money.

Questions and Answers: Employee or Independent Contractor?

I’m a bookkeeper trying to help a recently started, all volunteer nonprofit. The one concern I have is the administrative costs for the person who runs it. If the nonprofit were to reimburse that person for a missed day at work, would they be considered an employee of the nonprofit?

You can’t reimburse somebody for a missed day of work, that is not a “real” expense. That would be considered compensation. This could be a 1099 / independent contractor relationship OR an employee relationship. I would look carefully at the duties tests between the two and make your judgment. The IRS is pretty serious about making sure employers classify folks correctly. You can check out their resource pages here.

Question and Answers: Hiring Costs

We are a small nonprofit that had a change in our Executive Director. The costs to recruit, interview and move a new Executive Director to our state was extremely expensive. These costs are a one-time charge that are impacting our net assets. Is there a way that I can capitalize them to spread out the impact?

Not in this case. Capitalizing an expense is done for physical assets that have a long useful life so that the expense of the item is spread out over its time of use. Employees can’t get treated the same way.

Just make sure to clearly explain and footnote the situation on all of your reports and financials so people will not think there is something wrong with the organization and you should be OK.

Do you have a question? Click here to ask it